option to tax form

Whether that income is considered a capital gain or ordinary income can affect how much tax you owe when you exercise your stock options. A typed drawn or uploaded.

Blue Summit Supplies Tax Forms 1099 Misc 5 Part Tax Forms Kit 100 Count Security Envelopes Business Accounting Software Tax Forms

There are three variants.

. In fact you may also be able to claim ongoing expenses and other associated costs. Ad IRS-Approved E-File Provider. If you purchase taxable items to use in your business in Iowa fromFor more information about the regular local option tax consult the Local Option.

It also applies to any buildings that are subsequently built on that land. Although it is common to refer to a property when notifying an Option to Tax OTT an OTT actually applies to the land and includes the building standing on the land. Section 424 of VAT Notice 742A states that HMRC will normally acknowledge receipt of your notification although this is not.

These are generally options contracts given to employees as a form of compensationFor example incentive stock options. Get vat1614a0209 form for notification of an option to tax opting to tax land and buildings signed right from your smartphone using these six. Ad Shop a Wide Variety of Tax Forms from Top Brands at Staples.

Employers must report the income from a 2021 exercise of Non-qualified Stock Options in Box 12 of the 2021 Form W-2 using the code V. When you exercise an ISO your employer issues Form 3921Exercise of an Incentive Stock Option Plan under Section 422b which provides the information needed for tax-reporting purposes. Rent it out without opting to tax and you wont be able to claim the VAT back.

Complete Edit or Print Tax Forms Instantly. In a matter of seconds receive an electronic document with a legally-binding signature. Send the completed form and supporting documents.

Blue Summit Supplies Tax Forms 1099 Misc 4 Part Tax Forms Bundle With Software And Self Seal Envelop In 2021 Tax Forms Small Business Accounting Software Tax Software. Incentive Stock Option - After exercising an ISO you should receive from your employer a Form 3921 Exercise of an Incentive Stock Option Under Section 422b. The relevant form to send to HMRCs Option to Tax Unit in Glasgow is VAT1614A which means that the landlord does not need HMRCs.

For tax purposes options can be classified into three main categories. Ad Find the Right Tax Relief Plan that Suits Your Needs Budget. Vat1614a form pdf0209 form for notification of an option to tax opting to tax land and buildings on the go.

Refer to Publication 525 for specific details on the type of stock option as well as rules for when income is reported and how income is reported for income tax purposes. If you are notifying us of a decision to opt to tax land and buildings you are normally. Ad Access IRS Tax Forms.

In order to reclaim the VAT my client opted to tax. Please complete this form in black ink and use capital letters. Please complete this form in black ink and use capital letters.

The compensation element is already included in Boxes 1 3 if applicable and 5 but is also reported separately in Box 12 to clearly indicate the amount of compensation arising from. You complete form VAT 1614A there. The OTT provisions do not differentiate between commercial or residential land or buildings and.

8 October 2014 Form Apply for permission to opt to tax land or buildings. Resolve Your IRS Issues Now. It would mean being able to reclaim all the value added tax VAT on the purchase of the property and land as well as any professional costs and ongoing expenses.

However when you opt to tax you can get your cash back. Online Federal Tax Forms. Any option to tax does not affect a residential building or residential part of a building.

The option to tax allows a business to choose to charge VAT on the sale or rental of commercial property ie. Staples Provides Custom Solutions to Help Organizations Achieve their Goals. To make a taxable supply out of what otherwise would be an exempt supply.

For example you need a VAT 1614A in a different situation to a VAT 1614D. 10 June 2022 Form Revoke an option to. Ad Free For Simple Tax Returns Only With TurboTax Free Edition.

Get Your Max Refund Today. Opting to tax is quite easy. Open market stock options.

No Tax Knowledge Needed. Options contracts on equities that can be traded on the open marketFor example puts or calls on individual stocks or on. An Option to Tax arises only with commercial property or land and when you decide to sublet it or sell it on.

There are two main types of stock options. As it is a new commercial property you will be charged VAT. TurboTax Makes It Easy To Get Your Taxes Done Right.

Click Find Anthem Rate Review. Iowa Option to Purchase - Short Form US Legal Forms offers state-specific forms and templates in Word and PDF format that you can instantly download complete and print. If you do opt to tax you will need to charge the tenant VAT.

Option to tax form. Form it is strongly recommended that you read Notice 742A Opting to tax land and buildings available from our website go to wwwhmrcgovuk A paper copy and general guidance are available from our advice service on 0845 010 9000. We Have Compared the Top 10 Tax Relief Companies.

So in order to claim input tax on the cost of buying and improving the property our landlord must opt to tax it and be VAT-registered so that his rental income is standard-rated taxable rather than exempt. Decide on what kind of signature to create. The underlying principle behind the taxation of stock options is that if you receive income you will pay tax.

Option to tax form pdf Option to Tax Disapplication My client is a VAT registered Ltd Co that owns a portfolio of rental properties both commercial and residential. Form Disapply the option to tax land sold to housing associations. Prep E-File with Online IRS Tax Forms.

Select the document you want to sign and click Upload. This type of transaction can prove complicated however and will. 900901 is a.

The company purchased some land adjacent to a pub on which they incurred VAT. The company is now in the process of selling the. Follow the step-by-step instructions below to design youre vat 5l form.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Currently when a customer notifies of an intention to Opt to Tax a property through a VAT 1614A form we acknowledge the notification and carry out an extensive series of checks on the notification itself. I tend to remember option to tax forms by their numbers and letters.

Over 50 Milllion Tax Returns Filed.

Free Tax Information In 2022 Tax Software Estimated Tax Payments Filing Taxes

Form C S Is An Abridged 3 Page Income Tax Returns Form For Eligible Small Companies To Report Their I Business Infographic Singapore Business Income Tax Return

Old Vs New Tax Regime For Salaried Business Taxpayers Eztax In Business Tax Tax Filing Taxes

Tds Due Dates October 2020 Income Tax Return Due Date Solutions

Blue Summit Supplies Tax Forms 1099 Misc 5 Part Tax Forms Kit 100 Count Security Envelopes Small Business Accounting Software Business Accounting Software

W 2 User Interface W 2 Wage And Tax Statement Data Is Entered Onto Windows That Resemble The Actual Forms Imports Employee Informa Irs Forms W2 Forms Irs

Explore Our Example Of First B Notice Form Template Letter Templates Letter Writing Template Lettering

Income Tax Return Update Financepost In 2021 Finance Blog Finance Income Tax Return

Philadelphia Taxes Filing Taxes Tax Forms Tax Advisor

You Can File Your Tax Return On Your Own It S Easy Quick And Free When You File With Tax2win On Your Onenote Template Income Tax Preparation Tax Preparation

Tx302 Payroll Withholding Tax Essentials Payroll Taxes Payroll Medical Insurance

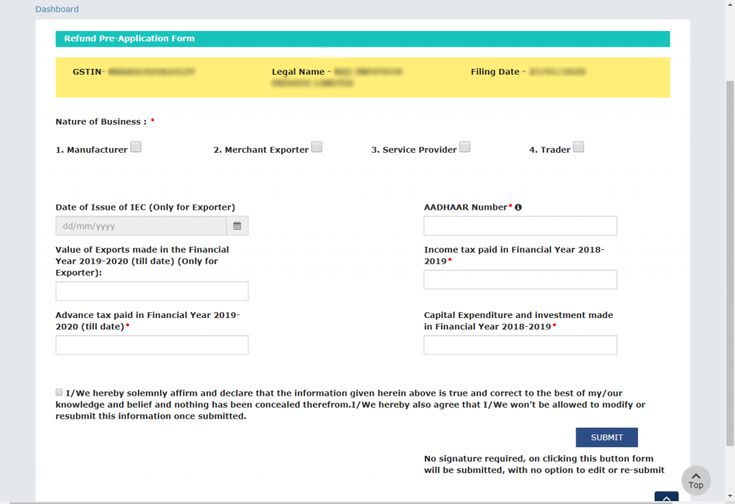

Gst Portal New Feature On Pre Fill An Application Form For Refund Tax Refund Application Form Filing Taxes

What Are Your Options When It Comes To Filing Your Singapore Company Tax Returns Understand The Difference Between The Two O Tax Return Singapore Filing Taxes

Tips For Buying Tax Exempt Textbooks Textbook Tax Tips

Does My Llc Need To File A Tax Return Even If It Had No Activity Tax Return Filing Taxes Llc

Due Dates For Tds Income Tax Return Itr Income Tax Return Tax Return Income Tax

Pin By Olivia Reyes On Pta Donation Letter Pto Fundraiser School Pto

Form 656 Ppv Offer In Compromise Periodic Payment Voucher Offer In Compromise Tax Debt Debt Problem